uk tax incentives for electric vehicles

20 of the cost of an electric taxi up to a maximum of 7500. Electric van can reduce their cost by 20 up to a maximum of 8000.

Road Tax Company Tax Benefits On Electric Cars Edf

Minimum rate for vehicles emitting 120g CO2km.

. Companies that buy fully electric cars can write down 100 of the purchase value against their profits before tax. CO2 emissions of 50-75gkm and a zero emission range of at least 20 miles. Plug-in electric vehicles emitting less than.

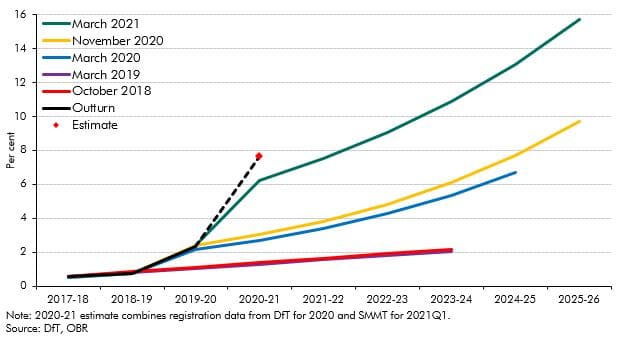

The 7500 credit will become available for all new cars and the 200000 cap would be eliminated - great news for Tesla and GM fans. Unfortunately Arizona does not offer a vehicle-related incentivealthough there is a federal tax credit available up to 7500 depending on the cars battery capacity. In September 2020 UK registrations for pure electric vehicles were 184 higher than the same month in 2019.

The unstoppable growth of the electric vehicle market creates clear opportunities for the businesses making selling and charging those vehicles. Everything mentioned is administered by OZEV. TAX BENEFITS PURCHASE INCENTIVES In the 27 member states of the European Union.

CO2 emissions zero emission range of at least 70 miles. 100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars. Tax on benefits in kind for electric cars.

From 2020 you wont be able to claim tax credits on a Tesla. More details Company car tax. The tax on any diesel company car is 4-8 higher.

Some other notable changes include. Fully-electric vehicles costing less than 40000 are exempt from the annual road tax. The car dealers will include the value of the grant in the vehicles price without any required actions from the clients themselves.

The electric car tax on BIK rate will increase to 1 in 2021 2022 and 2 in 2022 2023. CO2 emissions zero emission range between 10 and 69 miles. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

Additional Premium rate tax for all vehicles with a list price over 40000. Living in the UK. From today 18 March 2021 the government will provide grants of up to 2500 for electric vehicles on cars priced under 35000.

Other electric car tax benefits. Up to 75. Ford Electric Vehicle Government Incentives.

Using union labor making the total available tax credit 12500. Plug-in hybrids also increased by 139. These vehicles have no CO2 emissions and can travel at.

Environmental tax for electric vehicles. The grant will pay for 35 of the purchase price for these vehicles up to a maximum of 500. You may qualify for as much as 7500 in federal tax incentives for purchasing an all-electric Ford vehicle in 2020 or 2021.

13 in 2018-19 and 16 in 2019-20. The federal tax credit is a potential future tax savings. The UK governments Plug-In Car Grant PICG currently offers 2500 off the cost of an electric car but only for vehicles costing less than 35000.

Businesses that buy EVs can write down 100 of the purchase price against their corporation tax liability if the vehicle emits no more than 50gkm CO2 paying just 1 CCT in 2021 and 2 in 2022. If at least 50 of the battery components in your EV are made in the US. There are further financial incentives associated with driving an electric vehicle.

This is a great saving for businesses. Meanwhile registrations for petrol and diesel. This will mean the funding will last longer and be available to.

Arizona does offer a generous rebate via Tucson Electric Power TEP for residential customers who install a charging station or EVSE. Incentive scheme once a year limited funds. This currently stands at around 320 per year.

Aside from the electric car tax benefits outlined above. Every pure electric vehicle costing less than 40000 is exempt from the VED annual road tax. If a vehicle is listed at over 40000 and registered after 31st March 2017 you are subject to an additional Premium rate tax for the first 5 years of ownership on top of standard VED whether your vehicle is electric or not.

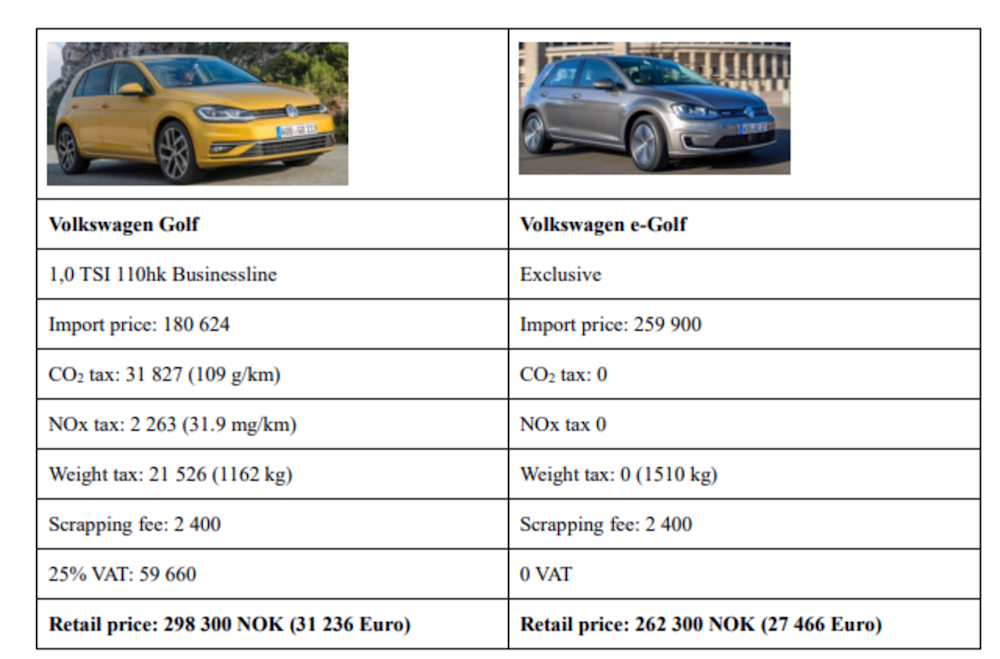

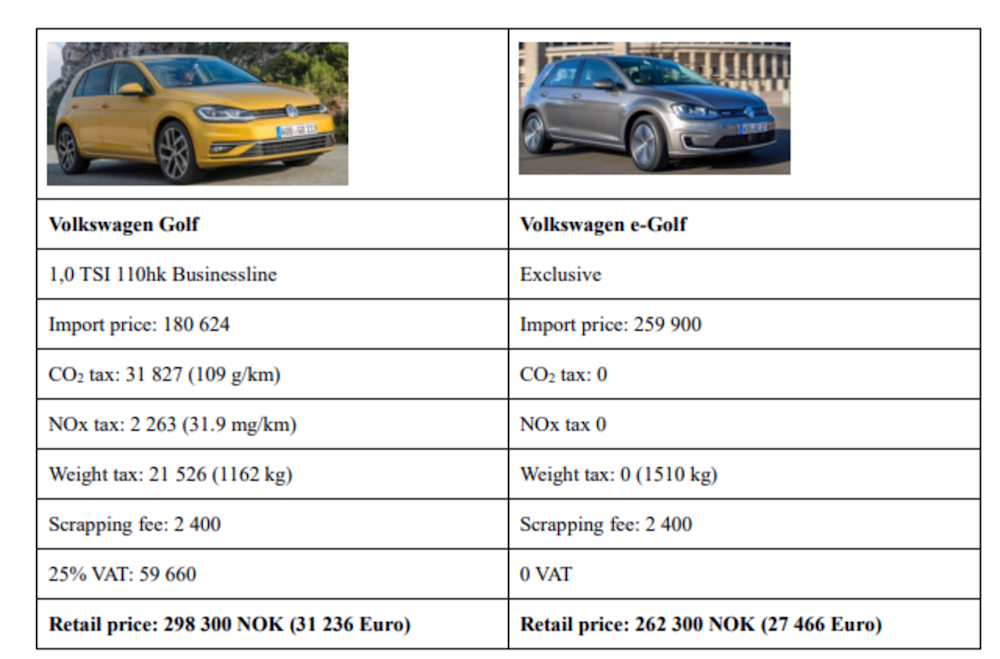

The UK also offers tax advantages for buying low to zero-emissions vehicles. There are also tax-exemption benefits on Registration Tax and VED Road Tax for zero emission vehicles and reduced tax for plug-in hybrid vehicles. From July 1 st until the end of the year the credit is only worth 1875.

By choosing a Tesla car your business can claim a 100 year one deduction for the cost of the vehicle. Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020. The amount of your.

As the electric car market has grown these incentives have changed and they will continue to evolve as these vehicles become more popular on our roads. One of the most important incentives for private vehicle owners to go electric is to take advantage of the Plug-In Car Grant which covers up to 2500 of the cars purchase price depending on the model. This funding is available for models costing up to 32000.

500 EV Tax Credit. 9333 for BEVs 5333 for PHEVs CYPRUS Exemption for vehicles emitting less than 120g CO2km. Theres currently zero tax on Benefit in Kind BIK during 2020 2021 for hybrid vehicles with emissions from 1 - 50gkm and a pure electric range of over 130 miles.

Pure electric vehicles costing less than 40000 are exempt from the Vehicle Excise Duty annual road tax. There would be an additional 5000 in available incentives if the car and battery parts were built within the US. Drivers who find themselves requiring access to the London Congestion Charge Zone in an electric vehicle can save 1500 per day.

EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before The electric car tax credit is only available to individuals with a gross income of 250000 or less decrease from before. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. Plug-in electric vehicles emitting less than 50gkm of CO2 have their company car tax set at only 9 for 2017-18.

Heres what it entails.

Electric Cars Save Hundreds In Tax But Look Out For Road Tolls Ahead News The Sunday Times

The Transition To Electric Vehicles Office For Budget Responsibility

Electric Vehicles Grants And Tax Benefits For Small Businesses Sage Advice United Kingdom

Electric Vehicles As An Example Of A Market Failure

Using Vehicle Taxation Policy To Lower Transport Emissions An Overview For Passenger Cars In Europe International Council On Clean Transportation

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Cars The Surge Begins Forbes Wheels

Plug In Electric Vehicles In Sweden Wikipedia

Plug In Electric Vehicles In Norway Wikipedia

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Vehicles Should Be A Win For American Workers Center For American Progress

Government Funding Targeted At More Affordable Zero Emission Vehicles As Market Charges Ahead In Shift Towards An Electric Future Gov Uk

A Complete Guide To Ev Ev Charging Incentives In The Uk