stash tax documents turbotax

As one of our. The 1099-DIV is a common form which is a record that Stash not your employer gave or paid you money.

Stash Review Read Before You Download Stash Invest App The Dough Roller

Based On Circumstances You May Already Qualify For Tax Relief.

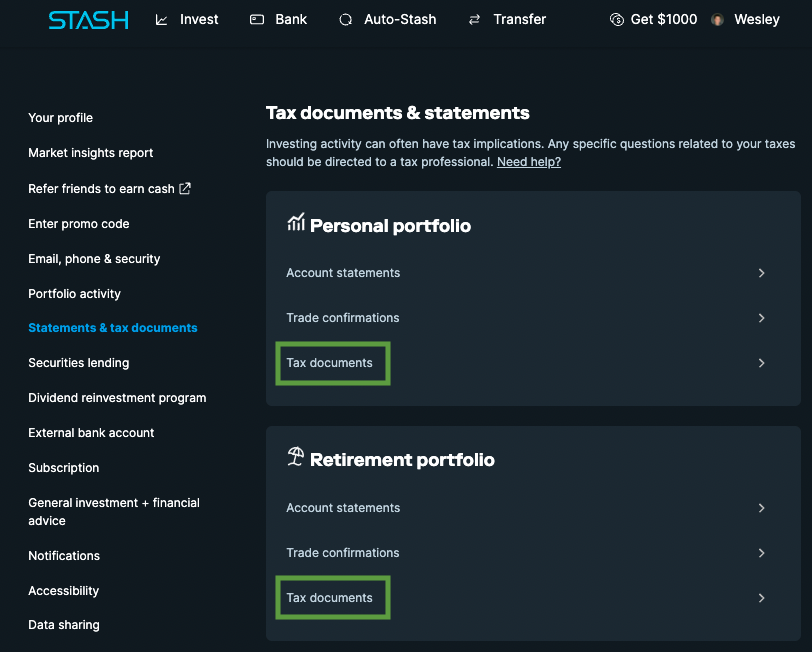

. Before you file your return get it reviewed by a tax specialist to ensure that your specific tax situation is handled correctly. Navigate to the account type you are. Snap and securely upload your tax documents.

-Line 11 on Form 1040 and 1040-SR for tax year 2020 -Line 8b on Form 1040. Click Tax Documents - now youve got the documentation. The YNAB budgeting app and its simple four-rule.

Get matched with the right. You are holding form 1099B. File Your Taxes Today.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Answer Simple Questions About Your Life And We Do The Rest. Stash tax documents turbotax.

Even if you bought shares at various dates or at different prices. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Your AGI Adjusted Gross Income can be found on.

If you earned more than 10 in dividends from your Stash investments youll receive. Select Statements Tax Documents from the menu on the left. 1099-DIV Dividends and Distributions A 1099-DIV tax form is for getting paid on dividends.

File With TurboTax Today. Stash is not a bank or depository institution licensed in any jurisdiction. Scroll down to the Documents section and.

Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. Based On Circumstances You May Already Qualify For Tax Relief. Ad Get Reliable Answers to Tax Questions Online.

Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax. File Now with Online Tax Forms. Great news if you are using TurboTax to file your taxes this year TurboTax will allow you to share your Stash account information and directly import your tax.

With Full Service we do your taxes for you in a. Let a dedicated tax expert do your taxes for you. The above link should take you to your documents.

Ad Search Over Hundreds Of Tax Deductions w TurboTax To Maximize Your Tax Refund. As the leader in tax preparation more federal. Certified Public Accountants are Ready Now.

Navigate to the account type you are looking for documentation on. Ad Step-by-step Guidance to Quickly File Your Tax Return. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns.

Sale of a personal. Category Cryptocurrency Tax Calculator. Up to 20 off TurboTax.

When you enter the info from the 1099B in the appropriate sections of TurboTax it will generate the form witht he. Interest 1099-int or substitute dividend slips 1099-div or substitute stock sales 1099-b or broker statement self-employment income and expenses. Always Free Federal No Upgrades No Suprises.

You enter the info from that form in 8949. Additional fees apply for e-filing.

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Turbotax Direct Import Instructions Official Stash Support

Stash 1099 Tax Documents Youtube

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches